Ridgeline Quarterly Update –Q2 2023

Updates on deals, portfolio news, and interesting things in our world

One Big Thing

One major development over the past nine months has been the broader adoption and investment focus on artificial intelligence, catalyzed by new capabilities in generative AI. We’re greatly encouraged by this given our interest in this segment since founding Ridgeline.

Although we have constantly refined our thesis since the early days, much remains valid even through the recent hype. We constantly question our thesis and have had to adapt to the latest advances in models, products, and technology, but we have maintained strong selection criteria as most of the companies founded during this “hype cycle” won’t create meaningful value. To put it bluntly, there is a lot of noise.

We have identified two driving forces that will likely continue to accelerate the AI segment. First, there will be an explosion of model development and usage across enterprises. Second, the lifecycle of models, and the tools and infrastructure required to execute on this lifecycle, will continue to create a high-value investment opportunity.

We expect large foundational models like GPT-3, Bard, StableDiffusion, LLaMA, Dall-E, and BERT to have wide adoption, but given the enterprise requirements for accuracy, security, and data protection, there will be no singular platform for AI.

Though we think foundational models will make up a plurality of use in the enterprise, the majority of spend and usage will accrue to the thousands of industry, company, or even use-case-specific models. There is a dimensionality to this as well: deployment on the cloud, on-prem, and at the edge each have unique requirements. For example, a company that uses a few models that ingest massive amounts of data will differ greatly in its infrastructure and tooling needs from a company that needs a few models running in thousands of edge locations.

What does this mean for the technology industry and venture capital? While much of the current attention is focused on foundational models, as the space matures, tooling, infrastructure, and security products will become critical.

This constellation of models and deployment preferences will likely mirror the explosion of software in the last decade and will require an expansive segment of infrastructure and tools. We see this toolset resembling DevOps in the software market. As an example, it doesn’t take much to see a company like Hugging Face, which just raised at a $4B valuation, becoming the “Github of AI”. This means that for Ridgeline our most intense areas of interest have been and will remain firmly below the application layer.

When looking at an AI tool, infrastructure, or an ops company, we have leaned into a few important diligence + selection criteria to help guide our decision-making.

As with all of our investments, everything begins with the founding team. We believe highly technical founders who have a deep understanding of their users are critical in the AI space. Taking that user focus into product development will have a key advantage in a crowded market where many products will struggle to build defensible moats. In many cases, users will be engineers and data scientists, but they could very well be UX designers, industrial engineers, or business analysts. Additionally, we believe talent attracts talent, and strong founders will be able to build the teams necessary to continue to compete over time.

Second is whether the product is solving a pain point in the market that we can validate with large enterprises. At this time, Ridgeline has invested in technology companies that are working to solve enterprise challenges in model deployment (Wallaroo), infrastructure management (Wallaroo + Neural Magic), data provenance and security (Cape Privacy + RKVST), embedded AI (AI Squared), and computing hardware (Cornelis Networks).

Lastly, we want to understand the market size. Typically, our bias here is for horizontal products that can stretch across multiple verticals. This requires a firm understanding of the pain points in AI ops and how far they stretch across industry verticals. For market-specific products, the market needs to either have high adoption rates for new technologies (e.g., technology startups) or the market must be very large (e.g., automotive).

Over the next few years, we see the AI space continuing to grow at speed, with the potential to create outsized value for venture capital firms. While there are a number of well-defined categories in the AI/ML space—including data pipelines, labeling and data creation, and data science platforms—most subsegments are not yet well-defined.

To illustrate the ambiguity, below is from the MAD Landscape, which has become the most comprehensive mapping and illustration of the machine learning, AI, and data market. MLOps is the single largest “category” in the market map. Knowing many of these companies, there is wide variance in the products here and value prop to customers. We anticipate this category to further segment, and dozens of companies to create new categories.

We’d like to highlight three areas that we are particularly excited about in the enterprise AI/ML space.

Software-defined AI infrastructure—given the high demand for (and low supply) and cost of GPUs, we expect frameworks, software, and runtime engines that allow for AI to be run on commodity compute to find users and grow in popularity. These products will unlock less sophisticated industries, those with low operating margins, and, importantly, open up edge use cases in a broader way.

Data-centric vs model-centric AI/ML—given large enterprises desire to maintain ownership and governance of their data, we expect many models to be built internally or brought to the data that enterprises already own. Tools supporting data tracking, collaboration, and reproducibility, data provenance and assurance will become important parts of the ecosystem. Additionally, in enterprises with regulated data, federated learning will become highly valuable.

Model Deployment, Monitoring and Orchestration—investments in platforms and tools that simplify the deployment and orchestration of machine learning models will be in high demand. These solutions enable efficient model deployment across different environments, facilitate scaling, and ensure model consistency and reliability. The performance and behavior of deployed machine learning models will be critical as well.

These investment areas address critical challenges in managing, deploying, monitoring, and governing machine learning models, enabling organizations to scale their AI capabilities efficiently and drive innovation in the field of machine learning.

AI has the potential to revolutionize numerous industries, such as government, finance, transportation, and manufacturing. It can enhance efficiency, accuracy, and productivity by automating routine tasks, assisting in decision-making, and enabling personalized experiences. AI-powered systems can also contribute to scientific research, discovering new insights, and accelerating innovation.

To leverage the opportunities and overcome challenges in the AI space, collaboration between academia, industry, and policymakers is crucial. Establishing ethical frameworks and regulations to govern AI applications, ensuring transparency, fairness, and accountability, will be vital.

Follow-on Investments

Satellite Vu raised $15.8 million prior to its successful satellite launch in June. The Series A-2 round was led by Molten Ventures, with participation from Ridgeline, Seraphim Space, A/O Proptech, Lockheed Martin and Stellar Ventures.

Portfolio Updates

Neural Magic partnered with Striveworks to add fast GPU-less model deployment options in Chariot MLOps Platform

Wallaroo.AI and VMware partner to speed the deployment of 5G edge Machine Learning

Low-code AI integration platform AI Squared named Michelle Bonat as new CTO

Q-CTRL welcomed Dave Kielpinski as Principal Quantum Control Scientist to accelerate quantum computing innovation

RKVST launched Instaproof, a new tool to instantly verify the authenticity of any file

Cornelis Networks appointed David Joseph as Chief Financial Officer

Smallstep named an Overall Leader in KuppingerCole Secrets Management Leadership Compass 2023

SatVu successfully launched first satellite, "HOTSAT-1", to map energy-inefficient buildings

Firmware backdoor discovered by Eclypsium in Gigabyte Motherboards, hundreds of models affected

From the Blog

Executive Spotlight: Michelle Bonat of AI Squared is Unlocking the Power of AI for Enterprises

Interesting Stuff

A focal point of discussion in the AI space centered around moats and defensibility for startups building in the space. A lot of attention was paid to this leaked Google memo. But, this revision of an older piece by Jerry Chen, partner at Greylock, was one of the best focused on the topic.

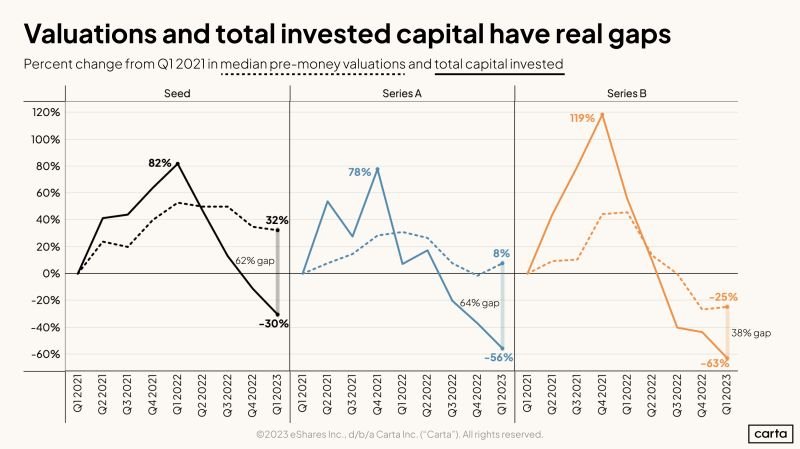

While Q1 may have signaled the floor for valuations at the early stage, capital invested is still way down across Seed, Series A, and Series B. The gap in the graphs below, from a post by Peter Walker from Carta, are showing a serious flight to quality.

The results of this survey of Seed investors by our friends at Eniac showed some of the unique qualities of the Seed market and where our peers saw opportunity and hype at that stage of investing.

These two posts by Madrona Ventures and Cowboy Ventures were great explainers on the GenAI stack and how databases, frameworks, and infrastructure may differ when leveraging or building foundational models.

Silicon Valley Defense Group put out the NatSec100, which is a list of prominent 100 national security focused startups. We think this list will go through large changes from year to year as the market is still quite immature. Exciting to see three Ridgeline portcos on the list though: ICON, Opentrons, and Eclypsium.